All Categories

Featured

Table of Contents

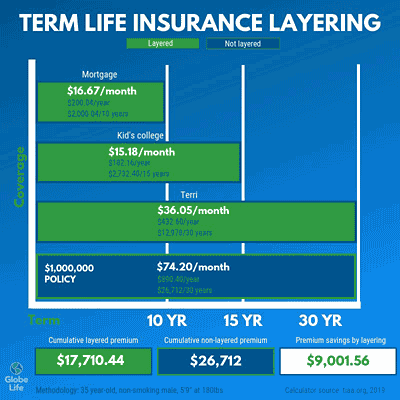

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations. Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies.

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. term life insurance with low premiums brokers offer. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow

If you pick degree term life insurance policy, you can budget for your premiums due to the fact that they'll remain the same throughout your term. Plus, you'll know exactly how much of a survivor benefit your beneficiaries will certainly receive if you pass away, as this quantity won't alter either. The rates for level term life insurance coverage will depend upon numerous factors, like your age, health and wellness standing, and the insurance firm you select.

When you experience the application and medical examination, the life insurance policy company will assess your application. They must inform you of whether you have actually been authorized quickly after you use. Upon approval, you can pay your very first premium and sign any pertinent documentation to ensure you're covered. From there, you'll pay your costs on a regular monthly or annual basis.

You can choose a 10, 20, or 30 year term and enjoy the included peace of mind you are entitled to. Working with a representative can help you discover a policy that functions ideal for your needs.

As you search for means to secure your financial future, you've most likely stumbled upon a wide array of life insurance policy options. group term life insurance tax. Selecting the best coverage is a big decision. You wish to locate something that will aid support your enjoyed ones or the causes vital to you if something takes place to you

Lots of individuals lean towards term life insurance coverage for its simplicity and cost-effectiveness. Term insurance coverage agreements are for a reasonably brief, specified duration of time yet have choices you can tailor to your requirements. Particular benefit choices can make your costs transform with time. Degree term insurance policy, nonetheless, is a kind of term life insurance policy that has regular payments and an imperishable.

Long-Term Level Term Life Insurance

Level term life insurance policy is a part of It's called "level" since your costs and the advantage to be paid to your enjoyed ones stay the exact same throughout the agreement. You won't see any type of changes in price or be left questioning about its worth. Some contracts, such as every year renewable term, may be structured with premiums that enhance with time as the insured ages.

Taken care of fatality benefit. This is additionally established at the beginning, so you can understand precisely what death advantage amount your can expect when you pass away, as long as you're covered and current on costs.

You agree to a set premium and death advantage for the duration of the term. If you pass away while covered, your death advantage will be paid out to liked ones (as long as your costs are up to day).

You may have the choice to for another term or, much more likely, restore it year to year. If your agreement has actually a guaranteed renewability clause, you might not require to have a brand-new medical examination to maintain your coverage going. However, your costs are most likely to increase since they'll be based on your age at revival time (joint term life insurance).

With this alternative, you can that will certainly last the rest of your life. In this case, again, you might not need to have any kind of new medical examinations, but costs likely will increase due to your age and new protection. term life insurance with accelerated death benefit. Various firms provide various choices for conversion, make sure to recognize your selections prior to taking this action

Effective Term Life Insurance With Accelerated Death Benefit

Consulting with an economic advisor likewise might aid you establish the path that straightens best with your overall method. Most term life insurance policy is level term throughout of the contract duration, yet not all. Some term insurance policy might come with a premium that increases in time. With decreasing term life insurance coverage, your death benefit decreases in time (this kind is often secured to specifically cover a lasting debt you're settling).

And if you're established for renewable term life, then your premium likely will rise annually. If you're discovering term life insurance policy and intend to guarantee straightforward and predictable economic protection for your family, degree term might be something to think about. Nevertheless, similar to any kind of sort of insurance coverage, it might have some constraints that don't satisfy your needs.

Specialist What Is Direct Term Life Insurance

Typically, term life insurance is more budget-friendly than irreversible insurance coverage, so it's an affordable means to safeguard monetary defense. At the end of your agreement's term, you have numerous alternatives to continue or move on from protection, typically without requiring a clinical test.

Just like other sort of term life insurance, as soon as the contract finishes, you'll likely pay greater premiums for coverage due to the fact that it will certainly recalculate at your present age and health. Repaired insurance coverage. Level term supplies predictability. If your monetary situation adjustments, you might not have the necessary insurance coverage and could have to acquire extra insurance coverage.

But that doesn't indicate it's a fit for every person. As you're buying life insurance coverage, below are a few crucial aspects to take into consideration: Spending plan. One of the benefits of level term coverage is you know the cost and the survivor benefit upfront, making it less complicated to without stressing over rises over time.

Age and wellness. Generally, with life insurance coverage, the healthier and younger you are, the much more inexpensive the protection. If you're young and healthy, it may be an attractive choice to secure in reduced premiums now. Financial obligation. Your dependents and monetary responsibility play a role in establishing your protection. If you have a young family, as an example, level term can aid give economic support during vital years without paying for insurance coverage much longer than necessary.

1 All bikers are subject to the terms and problems of the motorcyclist. Some states may differ the terms and conditions.

2 A conversion credit report is not offered for TermOne plans. 3 See Term Conversions area of the Term Collection 160 Product Overview for exactly how the term conversion credit is established. A conversion debt is not available if premiums or fees for the new plan will certainly be forgoed under the regards to a biker providing special needs waiver advantages.

Proven Level Term Life Insurance

Term Series products are released by Equitable Financial Life Insurance Policy Business (Equitable Financial) (NY, NY) and are co-distributed by Equitable Network, LLC (Equitable Network Insurance Firm of The Golden State, LLC in CA; Equitable Network Insurance Coverage Agency of Utah in UT; and Equitable Network of Puerto Rico, Inc. Term Life Insurance coverage is a kind of life insurance policy that covers the insurance policy holder for a specific quantity of time, which is known as the term. Terms generally range from 10 to 30 years and boost in 5-year increments, providing degree term insurance.

Table of Contents

Latest Posts

Best Burial Insurance Plans

Funeral Insurance Meaning

Company Funeral Policy

More

Latest Posts

Best Burial Insurance Plans

Funeral Insurance Meaning

Company Funeral Policy