All Categories

Featured

Table of Contents

Term Life Insurance Policy is a kind of life insurance policy policy that covers the insurance holder for a specific quantity of time, which is called the term. The term lengths differ according to what the individual selects. Terms typically range from 10 to three decades and increase in 5-year increments, providing degree term insurance.

They generally provide an amount of coverage for much less than irreversible sorts of life insurance policy. Like any policy, term life insurance policy has advantages and disadvantages depending on what will work best for you. The benefits of term life consist of affordability and the ability to customize your term size and insurance coverage amount based on your requirements.

Depending on the type of plan, term life can use dealt with premiums for the entire term or life insurance on degree terms. The fatality advantages can be taken care of.

*** Rates mirror plans in the Preferred And also Price Class issues by American General 5 Stars My representative was extremely well-informed and handy in the process. July 13, 2023 5 Stars I was pleased that all my needs were fulfilled immediately and professionally by all the representatives I spoke to.

How Does Term Life Insurance For Seniors Compare to Other Policies?

All documentation was digitally finished with access to downloading for individual data upkeep. June 19, 2023 The endorsements/testimonials provided must not be understood as a recommendation to acquire, or an indication of the worth of any type of service or product. The endorsements are actual Corebridge Direct consumers who are not affiliated with Corebridge Direct and were not offered payment.

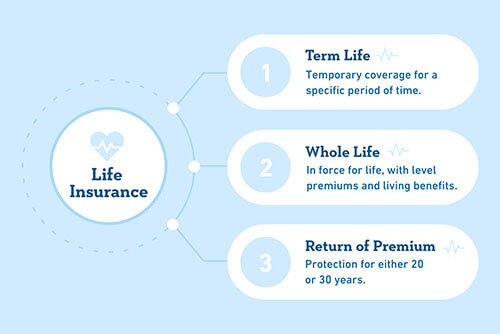

There are multiple kinds of term life insurance policy plans. As opposed to covering you for your whole life-span like whole life or universal life plans, term life insurance just covers you for a designated amount of time. Policy terms generally vary from 10 to thirty years, although shorter and longer terms may be available.

If you desire to keep insurance coverage, a life insurance provider might offer you the option to renew the policy for one more term. If you included a return of premium cyclist to your plan, you would certainly get some or all of the money you paid in premiums if you have outlasted your term.

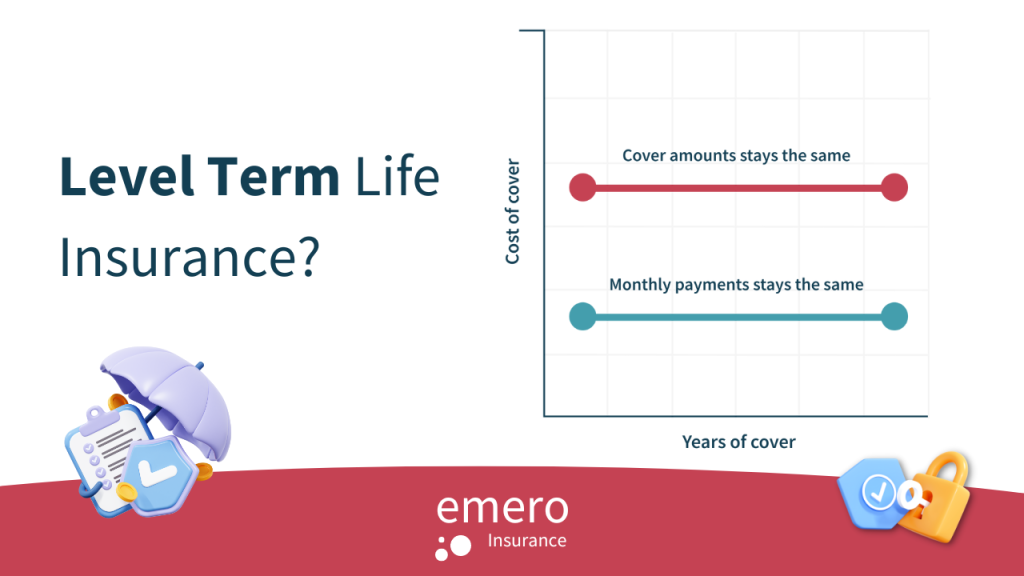

Degree term life insurance might be the most effective option for those who desire protection for a set amount of time and desire their premiums to remain secure over the term. This may relate to customers concerned about the price of life insurance policy and those who do not wish to change their survivor benefit.

That is since term plans are not ensured to pay out, while irreversible plans are, gave all premiums are paid., where the death advantage reduces over time.

On the other hand, you might be able to protect a more affordable life insurance rate if you open up the policy when you're more youthful. Comparable to innovative age, inadequate health can additionally make you a riskier (and much more expensive) candidate forever insurance coverage. Nevertheless, if the problem is well-managed, you might still be able to find budget-friendly coverage.

What is Term Life Insurance For Couples? All You Need to Know?

Nevertheless, health and wellness and age are typically a lot more impactful costs aspects than sex. High-risk leisure activities, like scuba diving and sky diving, might lead you to pay more for life insurance coverage. High-risk jobs, like home window cleaning or tree trimming, might also drive up your price of life insurance policy. The ideal life insurance policy firm and policy will depend upon the person looking, their personal score factors and what they need from their plan.

The initial step is to establish what you need the plan for and what your budget is. Some firms provide on-line pricing quote for life insurance coverage, yet numerous need you to contact a representative over the phone or in person.

1Term life insurance coverage uses short-term defense for an important period of time and is typically more economical than long-term life insurance. 2Term conversion guidelines and limitations, such as timing, may apply; as an example, there may be a ten-year conversion opportunity for some products and a five-year conversion opportunity for others.

3Rider Insured's Paid-Up Insurance policy Acquisition Alternative in New York City. 4Not offered in every state. There is a price to exercise this rider. Products and riders are available in approved jurisdictions and names and functions may differ. 5Dividends are not guaranteed. Not all participating policy owners are eligible for returns. For choose motorcyclists, the condition puts on the insured.

Our term life alternatives consist of 10, 15, 20, 25, 30, 35, and 40-year plans. The most preferred type is level term, meaning your repayment (costs) and payment (survivor benefit) remains level, or the same, till the end of the term duration. Voluntary term life insurance. This is the most simple of life insurance coverage alternatives and needs very little upkeep for plan owners

For instance, you could offer 50% to your partner and split the remainder among your adult youngsters, a moms and dad, a close friend, or perhaps a charity. * In some instances the fatality benefit may not be tax-free, learn when life insurance is taxed.

What is Level Premium Term Life Insurance? Key Considerations?

There is no payment if the plan runs out prior to your death or you live past the policy term. You may have the ability to restore a term policy at expiration, yet the costs will be recalculated based upon your age at the time of revival. Term life insurance policy is normally the least costly life insurance coverage offered because it supplies a survivor benefit for a limited time and doesn't have a money worth component like irreversible insurance - Life Insurance.

Life insurance isn’t just a policy; it’s a powerful way to secure your family’s financial stability. From protecting your loved ones from unexpected costs to planning for the future, the right life insurance policy ensures peace of mind. Term life insurance is a popular choice for those seeking temporary, cost-effective coverage, while whole life insurance provides lifelong protection and cash value growth. Universal life insurance is another flexible option, ideal for families and individuals looking to balance affordability with long-term financial goals.

For specific needs, final expense insurance ensures funeral costs are covered, and mortgage protection life insurance provides reassurance that your family can stay in their home. Accidental death insurance adds another layer of security for unique situations (whole life insurance vs term life insurance explained by agents). Many of these policies also include living benefits, allowing policyholders to access funds during critical times, such as illness or emergencies

Life insurance isn’t just about protecting your loved ones; it’s also a strategic tool for building a solid financial foundation. Speak with a licensed insurance agent today to explore policies designed for your specific needs, whether you’re planning for retirement, saving for college, or securing your family’s future. Request a free quote now to start building a secure tomorrow.

At age 50, the costs would certainly climb to $67 a month. Term Life Insurance coverage Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Source: Quotacy. Quotes are for a $250,000 30-year term life plan, for males and females in superb wellness.

Rate of interest prices, the financials of the insurance business, and state laws can also influence premiums. When you consider the quantity of insurance coverage you can obtain for your premium dollars, term life insurance coverage often tends to be the least expensive life insurance policy.

Table of Contents

Latest Posts

Best Burial Insurance Plans

Funeral Insurance Meaning

Company Funeral Policy

More

Latest Posts

Best Burial Insurance Plans

Funeral Insurance Meaning

Company Funeral Policy